Gambling Winnings On 1040

- Gambling Winnings On 1040

- Where Is Gambling Winnings On 1040

- Where Does Gambling Winnings Go On 1040

- Where To Enter Gambling Winnings On 1040

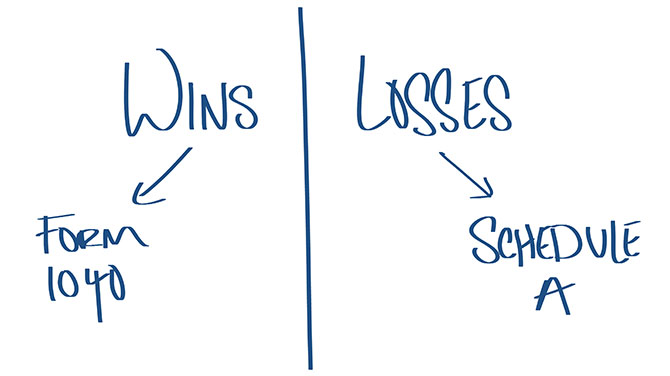

Gambling Winnings & Losses Gambling winnings are reported as Other Income on Line 21 of IRS Form 1040. While you may be able to deduct your gambling losses, gambling winnings are not directly offset by gambling losses in your tax return. Gambling winnings are fully taxable and must be reported on your tax return. Here are the top seven facts the Internal Revenue Service wants you to know about gambling winnings. Gambling income includes – but is not limited to – winnings from lotteries, raffles, horse and dog races and casinos, as well as the fair market value of prizes. Gambling winnings, however, are considered to be 'not effectively connected' and must generally be reported on Form 1040NR. Such income is generally taxed at a flat rate of 30%. Nonresident aliens often cannot deduct gambling losses. Sports gambling winnings are subject to income tax and you must report them on your tax return, even if you don’t receive tax documentation for the gambling income. Gambling agencies aren’t required to report your winnings unless you win at least 300 times what you bet and that amount is over $600 (or otherwise subject to federal income tax.

Taxes are probably the last thing on your mind during an exciting gambling session. However, they inevitably come up following a big win or profitable year.

You may have two main questions at this point:

- Do I need to pay taxes on my wins?

- If so, how much do I have to pay?

The following guide discusses whether your gambling wins are taxable and other important topics regarding this subject.

The Short Answer Is Yes

I’ll cut right to the chase: yes, you do need to pay federal taxes on gambling winnings in the United States. This is especially true when you net a big win and receive a W-2G form.

According to the IRS, a gambling establishment should issue a W-2G when you win an amount that’s subject to federal income tax withholding (24% of win).

Slot machines present a famous example of when you’ll receive a W-2G form after winning so much. Casinos must issue a form when you win a prize worth $1,200 or more through slots or video poker.

As for the second point, a sportsbook or racetrack must withhold federal taxes when you win a bet worth 300x your initial stake. If you wager $5 and win $3,000, for example, then the bookmaker will issue a W-2G form and withhold $720 (24%).

Gambling Winnings On 1040

Here’s a broader look at the W-2G and tax withholding threshold for different types of gambling:

- $600+ through sportsbooks and racetracks (provided it’s 300x your stake).

- $1,200+ through a slot machine, video poker machine, or bingo game.

- $1,500+ through keno.

- $5,000+ through a poker tournament.

All Winnings Are Subject to Taxation

Technically, you’re supposed to report any gambling winnings—big or small. Even if you win $20 in an office betting pool, the IRS wants to know about it.

If you want to stay above board, then you should report all wins on Form 1040 (under “other income”). As I’ll cover later, you can deduct losses from winnings as well.

Furthermore, any amount that’s withheld by a casino, poker room, sportsbook, or racetrack is deducted from what you owe. Gambling establishments keep 24% of a win when they do withhold money.

W-2G Forms Don’t Apply to Table Games

You’ll receive a W-2G when earning big wins through most types of gambling. However, casino table games are an exception to the norm.

Unlike a jackpot game (e.g. video poker) or a poker tournament, casinos have no idea how much money you start with in a table game. Therefore, they can’t really determine when you do and don’t experience big wins.

Examples of table games that are exempt from W-2G forms include:

- Baccarat

- Blackjack

- Caribbean stud

- Craps

- Roulette

- Three-card poker

The IRS still expects you to pay taxes on profits earned through table games. Again, though, the casino can’t issue a W-2G because they can’t tell how much money you’ve actually won.

Some States Tax Gambling Winnings

Most states tax your income, including gambling winnings. Depending upon where you live, you’ll probably need to pay taxes to both the IRS and your state.

For Example:Michigan features a 4.25% flat income tax. The Wolverine State expects you to pay this same 4.25% rate on gambling wins.

West Virginia, on the other hand, doesn’t tax your winnings. Casinos/sportsbooks in the Mountaineer State only withhold federal taxes (when necessary).

Assuming you travel to another state to gamble, you may have two states wanting taxes. Luckily, though, you won’t be subject to double taxation.

Instead, your home state will give you credit for whatever taxes are paid to the state where the winnings occurred.

Can You Deduct Losses?

You can deduct gambling losses from winnings. However, these deductions are itemized rather than standard deductions.

Here’s an example to explain:

- You win $5,000 through sports betting.

- You lose $4,500.

- You must report the full $5,000—not $500 (5,000 – 4,500)—under other income.

- Meanwhile, the $4,500 is reported through various itemized deductions.

In short, itemized deductions are expenses that reduce your taxable income. The standardized variety includes flat-dollar, common deductions.

You may be able to save more money through itemized deductions. However, standard deductions are easier to deal with and also have the potential to save you more money.

Regardless, you must use itemized deductions when dealing with losses. This means spending more time on your tax returns or working with an accountant.

Keep in mind that you won’t receive a tax refund for gambling losses. Instead, you can only deduct an amount equal to your winnings each year. If you win $3,500, for example, then you can’t deduct more than $3.5k and expect a return.

Keep Records on Wins & Losses

The IRS may take your word at face value when it comes to gambling. Of course, they also have the ability to audit you when they deem it necessary.

That said, you don’t want to guestimate on your wins and losses. Instead, you want proof through the form of records.

Journals offer a great way to record your gambling activities. You can log the following for each entry:

- Date of gambling session

- Location of the establishment

- Game played

- Starting bankroll

- Ending bankroll

Such entries don’t guarantee you’re being honest. However, they at least show the IRS that you’re making a legitimate attempt at recordkeeping.

You can take your recordkeeping efforts even further by holding onto any other relevant documents. Betting slips, winning tickets, canceled checks, bank statements, W-2G forms, and anything else of relevance are all worth saving.

What Happens If You Don’t Report Gambling Winnings?

The IRS fully expects you to report gambling winnings and especially annual profits. They don’t take kindly to you failing to report these wins.

Of course, you’re unlikely to draw an audit for winning a $25 sports bet. You stand a higher chance of being audited, though, if you win enough for a W-2G form.

In this case, the casino/sportsbook/racetrack also sends a copy of the from to the IRS. The latter features reliable software that can match up your reported income with documentation of nonreported income.

Assuming you fail to report gambling winnings, then the IRS may do little more than send a letter and issue a small fine. You should definitely pay up, or at least work out a payment plan, in this case.

You’ll face more serious consequences, though, if you fail to report a huge win and lie about the matter when/if caught. Refusal to pay and/or heavy efforts to cover up the deceit will lead to bigger fines and possibly jail time.

Gamblers Stand Increased Chances of an Audit

Nobody likes attracting an audit from the IRS. Unfortunately, the chances of being audited increase for gamblers.

This is especially true when you net a big win and receive a W-2G. Of course, you can reduce the odds of being audited by claiming anything on the form.

The IRS may also become suspicious if you claim big losses on your tax return. You’ll put the taxman on increased alert when winning a huge prize (e.g. $50,000) and claiming a matching amount of losses.

Also, you can’t write off hotel stays, meals, and entertainment as a casual gambler. You must be a professional to claim such itemized deductions.

How Do Professional Gamblers Report Winnings?

Pro gamblers claim winnings on Schedule C as a self-employed person rather than as other income on Form 1040.

Even as a professional, you can’t deduct more losses than winnings in a year. You’re stuck in a tough situation with treating gambling as a day job, yet not being able to file losses that exceed winnings.

As mentioned before, though, you’re able to deduct business expenses like hotel stays and meals. These expenses just need to be a legitimate part of your business.

Conclusion

In answer to the original question, yes, you’re supposed to claim real money gambling winnings on federal tax forms. Even if you end up losing money on the year, the IRS wants to see your wins and losses.

Of course, tax collectors don’t care a great deal when you win $200 on the year. They spend most of their time looking for bigger winners.

The times when you want to be especially diligent in this matter include:

- When you book a large win and receive a W-2G form.

- If you win a significant amount of profits throughout the year.

- When you win 600x your bet with a sports or horse wager.

Again, the IRS and your state (if applicable) expect all gambling winnings to be reported. But you can use some commonsense in deciding when reporting wins are truly necessary.

Please enable JavaScript to view the comments powered by Disqus.Letting the Door Hit You in the Tax on the Way Out: IRS Issues Relief Procedures for Certain Persons Who Relinquished US Citizenship But Wish to Complete Tax Compliance

The Dual Liability Provisions for a Responsible Person under California Sales Tax Law

Can You Net Gambling Wins With Gambling Losses on Your Tax Return?

Taxpayers who gamble casually (meaning they do not qualify as being professional gamblers under the tax code) can net wins and losses within a single session of gambling, but not from different days. The total of multi-session wins would be reportable as “other income” on Form 1040 but the total of multi-session losses would be reported on Schedule A under “Other Itemized Deductions,” up to the amount of your winnings.

Because casinos report larger winnings to the IRS on Form W-2G, failing to use this method may cause the IRS to see a discrepancy and trigger an audit. The general IRS advice on this topic can be found on the IRS’s website (click here).

The netting ofwins and losses is addressed by the Tax Court in Shollenberger v.Commissioner, T.C. Memo. 2009-306 (2009), where the court followed IRSguidance in stating:

A key question in interpreting §165(d) is the significance of the term “transactions.” The statute refers to gains and losses in terms of wagering transactions. Some would contend that transaction means every single play in a game of chance or every wager made. Under that reading, a taxpayer would have to calculate the gain or loss on every transaction separately and treat every play or wager as a taxable event. The gambler would also have to trace and recompute the basis through all transactions to calculate the result of each play or wager. Courts considering that reading have found it unduly burdensome and unreasonable. See Green v. Commissioner, 66 T.C. 538 (1976); Szkirscak [sic] v. Commissioner, T.C. Memo. 1980-129. Moreover, the statute uses the plural term “transactions” implying that gain or loss may be calculated over a series of separate plays or wagers.

The better view is that a casual gambler, such as the taxpayer who plays the slot machines, recognizes a wagering gain or loss at the time she redeems her tokens. We think that the fluctuating wins and losses left in play are not accessions to wealth until the taxpayer redeems her tokens and can definitively calculate the amount above or below basis (the wager) realized. See Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955). For example, a casual gambler who enters a casino with $100 and redeems his or her tokens for $300 after playing the slot machines has a wagering gain of $200 ($300-$100). This is true even though the taxpayer may have had $1,000 in winning spins and $700 in losing spins during the course of play. Likewise, a casual gambler who enters a casino with $100 and loses the entire amount after playing the slot machines has a wagering loss of $100, even though the casual gambler may have had winning spins of $1,000 and losing spins of $1,100 during the course of play. [Fn. ref. omitted.]

Thus, the net win from the session as a whole (e.g., when the taxpayer actually cashes out for the day) would be reported under “other income” while the net loss from another day’s session would belong on Schedule A.

Where Is Gambling Winnings On 1040

Fortunately, those who use casinos’ player cards often can get a statement from the casino breaking down daily wins and daily losses. Some casinos, however, decline to provide this level of detail to their own customers despite having such records. Instead, those casinos will provide only an annual net win or loss statement. As this may cause problems in an IRS audit if the auditor is a stickler for technicalities, a taxpayer may prefer to patronize casinos which provide the additional detail as a higher-level of customer service.

Where Does Gambling Winnings Go On 1040

The author of this post is Daniel W. Layton, a former IRS trial attorney and ex-federal prosecutor in the Tax Division of the Los Angeles U.S. Attorney’s Office. He is a tax attorney representing private clients in Newport Beach and Fullerton, Orange County, California.

Where To Enter Gambling Winnings On 1040

Posted on 12/11/2019 by Daniel Layton.